Simple Moving Average

Simple Moving Average

The 10-period SMA is the red line, and the blue is the 20-period. In this example, you would have bought once the red line closed above the blue which would have given you an entry point slightly above $424. In the below charting example of Apple from 4/9/2013, the 10-period SMA crossed above the 20-period SMA. You will notice that the stock had a nice intraday run from $424 up to $428.50. Or the 50 and 200 are the most popular moving averages for longer-term investors.

If you don't agree with any part of this Agreement, please leave the website now. All information is for educational purposes only and may be inaccurate, incomplete, outdated or plain wrong. Macroption is not liable for any damages resulting from using the content. No financial, investment or trading advice is given at any time.

Moving averages lag behind current price action because they are based on past prices; the longer the time period for the moving average, the greater the lag. Thus, a 200-day MA will have a much greater degree of lag than a 20-day MA because it contains prices for the past 200 days. You almost stop seeing price variations after you draw the moving average on a chart. The crossover of two moving averages—like five-day and ten-day moving averages—is used by some traders as entry and exit points. When the five-day SMA crosses over the ten-day SMA, it’s used as an entry signal.

In other words, mastering the simple moving average was not going to make or break me as a trader. I'm not going to drain this concept in this article, as the focus of this discussion is around simple moving averages. It's around late summer at this point, and I was ready to roll out my new system of using three simple moving averages. So, after reviewing my trades, I, of course, came to the realization that one moving average is not enough on the chart.

Many investors and traders look at the 50-day moving average. We place a stop-loss order below the bottom prior to the cross.

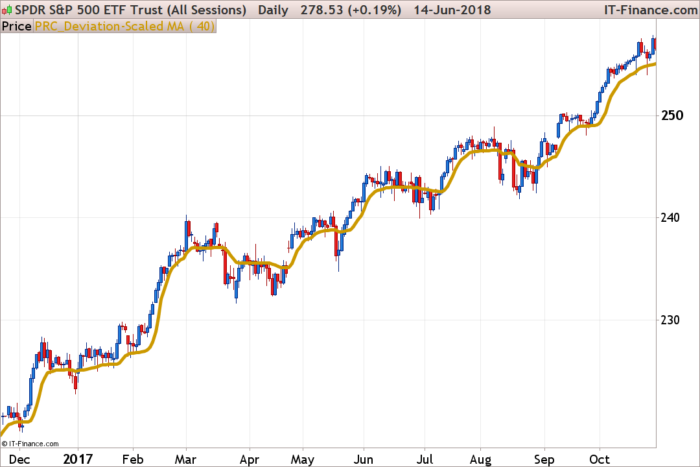

As you can see, you can use moving averages to help show whether a pair is trending up or down. Combining this with your knowledge on trend lines, this can help you decide whether to go long or short a currency.

A day trading pivot point strategy can be fantastic for identifying and acting on critical support and/or resistance levels. Moving averages (MA) are the basis of chart and time series analysis. A linearly weighted moving average is a type of moving average where more recent prices are given greater weight in the calculation, and prior prices are given less weight.

An increase in volume is frequently an indicator a price jump either up or down, is fast approaching. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements.

The trade needs to be held until the two moving averages create a bearish sell signal. Above you see the 50-day moving average chart of Bank of America.

- Time management – Don’t expect to make a fortune if you only allocate an hour or two a day to trading.

- If you feel that you need to try and capture more of your gains, while realizing you may be shaken out of perfectly good trades- the exponential moving average will suit you better.

- You will notice that the long moving average lags behind the price – it always goes in the same direction as the price, but takes a bit more time to get moving.

- Moving averages are the most common indicator in technical analysis.

- It is based on past prices and is therefore a “lagging” indicator.

For those of you not familiar with these strategies, the goal is to buy when the 50-period crosses above the 200-period and sell when it crosses below. Now that I have given you just enough doubt before even attempting to trade with the simple moving average let's review a few ways to make money with the SMA.

As a general guideline, when the price is above a simple or exponential MA, then the trend is up, and when the price is below the MA, the trend is down. For this guideline to be of use, the moving average should have provided insights into trends and trend changes in the past. Pick a calculation period—such as 10, 20, 50, 100, or 200—that highlights the trend, but when the price moves through it tends to show a reversal. Test out various MAs to see which works best by altering the inputs on the indicator in your charting platform. Different MAs make work better on different types of financial instruments, including stocks.

Especially if you are a short term trader, you probably feel the urge that you must react as quickly as possible to stay ahead of the markets. You probably want to catch every new trend in its very beginning. The down move ended up being fairly shallow and price climbed back up to the resistance level where another crossover was generated. This trade finished roughly breakeven or for a very small loss.

One solution would be to shorten the periods of the moving averages such that they react faster, hug price more tightly, and remain closer to the resistance level. The simple moving average (SMA) and the exponential moving average (EMA) are the two most common types of the indicator. The Double Exponential Moving Average (DEMA) is a technical indicator similar to a traditional moving average, except the lag is greatly reduced. The Guppy Multiple Moving Average (GMMA) identifies changing trends by combining two sets of moving averages (MA) with multiple time periods. Each set contains up to six moving averages, for a total of 12 MAs in the indicator.

And some combine various moving averages and use crossovers of different ones to confirm trend shifts and entry points. But like all indicators, there should be confluence among different tools and modes of analysis to increase the probability of any given trade working out. Similar to SMAs, periods of 50, 100, and 200 on EMAs are also commonly plotted by traders who track price action back months or years.

We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. We're also a community of traders that support each other on our daily trading journey. Now that you have a better understanding of how the SMA and the EMA are calculated, let's take a look at how these averages differ. By looking at the calculation of the EMA, you will notice that more emphasis is placed on the recent data points, making it a type of weighted average.

The shorter the time span used to create the average, the more sensitive it will be to price changes. The longer the time span, the less sensitive, or more smoothed out, the average will be.

Moving Averages

If you were to plot a 5 period simple moving average on a 30-minute chart, you would add up the closing prices of the last 150 minutes and then divide that number by 5. Basically, a simple moving average is calculated by adding up the last “X” period’s closing prices and then dividing that number by X. Simple, in other words, arithmetical moving average is calculated by summing up the prices of instrument closure over a certain number of single periods (for instance, 12 hours). The Moving Average Technical Indicator shows the mean instrument price value for a certain period of time. When one calculates the moving average, one averages out the instrument price for this time period.

For those of you not familiar with displaced moving averages, it's a means for moving the average before or after the price action. My path to this trading edge was to displace the optimized moving averages. I was using TradeStation at the time trading US equities, and I began to run combinations of every time period you can imagine. The need to put more indicators on a chart is always the wrong answer for traders, but we must go through this process to come out of the other side.

Комментарии

Отправить комментарий