Price Action Definition and Explanation

Price Action Definition and Explanation

Traditionally, the close can be above the open but it is a stronger signal if the close is below the opening price level. However, the sellers are not strong enough to stay at the low and choose to bail on their positions.

Price actiondescribes the characteristics of a security’s price movements. This movement is quite often analyzed with respect to price changes in the recent past. Overtrading is an account killer, and no trader is invincible.

An Introduction to Day Trading

Spider and radar charts are also known as web charts, star charts or polar charts. If you have a large set of different data groups, using spider and radar charts are better than column ones. The radar chart is good for showing multiple data groups in terms of 2D diagrams of at least three variables on axes. This type of chart is normally used for explaining trends over periods.

When the price of an asset has been moving with a certain tendency, once it breaks that tendency, it alerts traders to a new possible trading opportunity. For example, assume a stock has traded between $11–$10 for the last 20 days, then moves above $11. This change in tendency alerts traders that the sideways movement has possibly ended and that a possible move to $12 (or higher) has begun. Using historical charts and real-time price information such asbids, offers,volume, velocity, and magnitude, the price action trader looks for a favorable entry point for their trade. A favorable entry point is one that allows risk to be controlled, but also offers a potential profit.

I hope you have found this article helpful as you continue along your path of becoming a professional day trader. You can use our platform to simulate your performance over the last year, to get a number for yourself. I also found it interesting that he made it a point to clarify that traders are not evil. From the sounds of it, he is trading volume and can potentially have an impact on the price of a contract on the exchange. Good luck trying to get accurate data for the elite world of private equity traders.

Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. The candlesticks will fit inside of the high and low of a recent swing point as the dominant traders suppress the stock to accumulate more shares. It doesn't really matter which strategy or system you end up using.

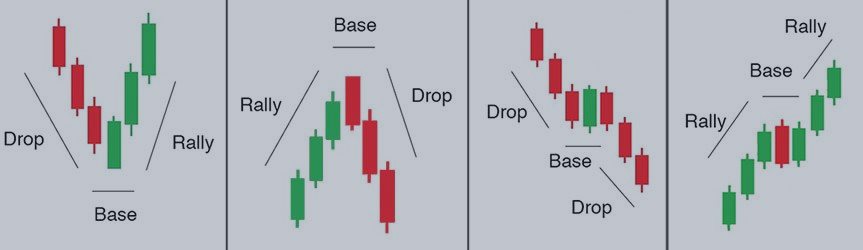

Simple Ways to Identify the Market Trend

A shooting star shows buyers pushing the market to a new high. However, the buyers are not strong enough to stay at the high and choose to bail on their positions. This causes the market to fall lower, leading sellers to also step into the market. The open and close price levels should both be in the lower half of the candle.

- Another thing you should be asking yourself is how patient you are.

- Click here to download The Ultimate Guide to Price Action Trading(includes additional trading strategy and resources not shown here).

- Introducing to you, The M.A.E Trading Formula, a proprietary trading technique I’ve developed to help traders get results, fast.

- The reason price action works, and works well, is because everyone is looking at the same chart, with respect to the same time frame of course.

This doesn't work for me, as I do not like that much risk, but it can work for some. Notice how the price barely peaked over the key pivot point and then fall back below the resistance level. In order to protect yourself, you can place your stop below the break out level to avoid a blow-up trade. However, there is some merit in seeing how a stock will trade after hitting a key support or resistance level for a few minutes. Trading comes down to who can realize profits from their edge in the market.

An intraday trader opens (buys) and closes (sells) their trades (also called positions) within the trading day, leaving no trades open overnight. Day trading is often glamorised as an easy way to get rich quickly.

This is just an example to get you thinking about how to develop your own trading methodology. Any strategy, will have winning and losing trades so manage your risk sensibly. If the trade has not triggered by the open of a new candle, cancel the order.

The basic idea behind price action is that we’re studying how the market moves relative to previous price movement. Rayner Teo is an independent trader, ex-prop trader, and founder of TradingwithRayner. The best article for price action strategies i have come across.Thanks. Alternatively, you can also trade strategies with no correlation to trend following to smoothen out your equity curve. I agree, there’s always something to learn each time from the markets.

You’re one of the few people in the world of trading that really inspire fellow traders. Keep it up Rayner, really appreciating the free nuggets you been giving. My losses were well, little compared to all the account I blowed up before. This is probably the longest time my real account have ever withstand! Although I am at -9% I am optimistic that by following all the principles of trend following, I am waiting patiently for that day just like how your trade with USDJPY.

This causes the market to rally back up, leading buyers to also step into the market. The open and close price levels should both be in the upper half of the candle.

The article will show you the top 10 common types of charts and their tips to use. Make sure you follow this step-by-step guide to properly read the Forex volume. The Chaikin indicator will add additional value to your trading because you now have a window into the volume activity the same way you have when you trade stocks.

Each candle or bar represents one unit of time; at the top of price charts is typically a setting that allows you to modify what one unit of time represents. If the timeframe is set to daily, this means that each candle or bar represents one day's worth of price activity. If it is set to 5 minutes, this means each candle or bar represents 5 minutes of price activity.

Комментарии

Отправить комментарий