How To File Taxes As A Forex Trader, Tax articles, Forex software

How To File Taxes As A Forex Trader, Tax articles, Forex software

If someone is trading with such low amounts, then they should expect low returns… It’s that simple. Both trades have same stop loss and opened same time, using price action signal. Following this, isn’t it wise to invest minimal discretionary amounts when one is doing so as another level of practicing Forex trading? For me, starting with these small amounts is the real PRACTICE trading, to counter the deceptive demo trading offered by brokers.

Speculative currency trades are executed to profit on currency fluctuations. Currencies can also provide diversification to a portfolio mix.

How is a currencys value determined ?

Last three years growth outstripped a 19% rise from 2007 to 2010, but trailed the record 72% increase in activity on Forex markets reached in the period. As well as being part of Soros' famous Black Wednesday trade, Mr Druckenmiller boasted an incredible record of successive years of double-digit gains with Duquesne, before his eventual retirement. Druckenmiller says that his trading philosophy for building long-term returns revolves around preserving capital, and then aggressively pursuing profits when trades are going well. This approach downplays the importance of being right or wrong. This theory suggests there is a feedback mechanism between perception and events.

That means you can afford to lose the entire amount without it affecting your day to day life. You can still pay all your bills, provide for your family, etc.

Let’s open up their minds and make them benefit from Nial’s good works. I also like for being in this part of last paragraph “to be around other traders who have similar goals and to continue my own learning journey”. Important- On Average, 15,000 + People will Read This Educational Article Today, So I Would Really Appreciate if You Can All Make A Genuine Comment Below the Article and Share it on Facebook and Twitter with fellow traders. Click the “Like Button” to add/share it to Facebook, post it on Twitter, and Of course, share your feedback with me by making a cool comment below this article. Thanks alot for your help in sharing these lessons with others.

How can retail traders with the right discipline and education deal with such unjust acts by the brokers? I am an advocate of compounding on an account and would not like to victimized by my brokers for trying to grow my investment on their platform after all they are making a lot of money from spreads. When they become a consistently profitable Forex trader finally, they have enough money to open a professional live Forex trading account with a bank to trade professionally and grow the money they make. Doing everything else discussed in this article will help you to not over-trade.

I’ve been able to grow a $3000 acvount to over 7k in just two weeks of trading and I didn’t even trade everyday. What a person needs for success is simply proper education and emotional intelligence. Most people think that they can learn to make money through Forex trading within a short time, and become a full-time Forex trader who makes thousands or even millions of dollars. There is no consistently profitable and professional currency trader who trades through the retail Forex brokers.

Like I said I think it’s good to make people aware that it’s not a quick rich scheme, but in a trillion dollars market with 24/7 (except the weekend) access there are a lot of possibilities. But yes he showed me every single trade and his account growth.

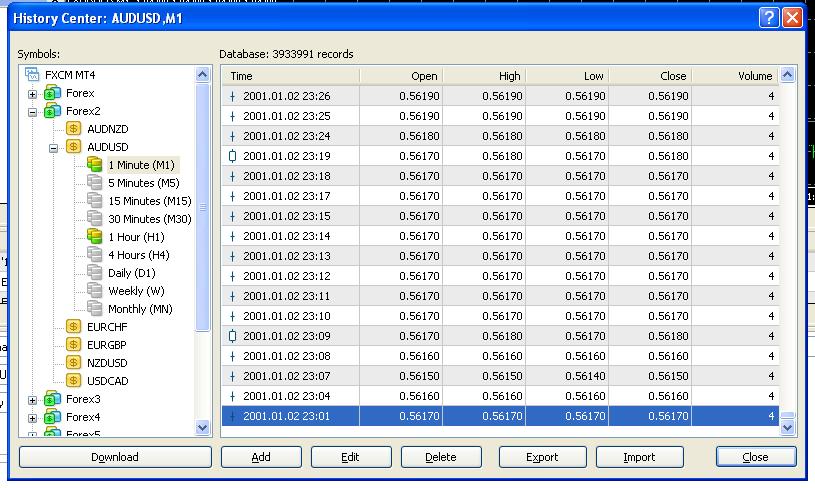

- In 2003, FXCM expanded overseas when it opened an office in London which became regulated by the UK Financial Services Authority.

- This allows them to take positions knowing that the price will most probably behave the same in this instance as before.

- Foreign exchange was introduced so citizens will have more monetary stableness and reliability.

- You would buy if you think that the price of the euro against the dollar is going to rise, that is, if you think you will later be able to sell your €1 for more than $1.30.

- This was played out in his famous sterling short, where the devaluation of the pound only occurred when enough speculators believed the BoE could no longer defend its currency.

The operating company, known as FXCM Group, is now owned by Jefferies Financial Group, which changed its name from Leucadia National Corporation in 2018. Global Brokerage shareholders lost over 98% of their investment since January 2015. When interest rates in higher yielding countries begin to fall back toward lower yielding countries, the carry trade unwinds and investors sell their higher yielding investments. An unwinding of the yen carry trade may cause large Japanese financial institutions and investors with sizable foreign holdings to move money back into Japan as the spread between foreign yields and domestic yields narrows. This strategy, in turn, may result in a broad decrease in global equity prices.

What Makes Breakeven Forex Trades Good or Bad?

This helped the Europeans spread currency trading throughout Europe and the Middle East. As these currencies are not so frequently traded the market is less liquid and so the trading spread may be wider.

Then find out how you compare to other traders before you start your forex training journey. Founded in 2013, Trading Pedia aims at providing its readers accurate and actual financial news coverage. Our website is focused on major segments in financial markets – stocks, currencies and commodities, and interactive in-depth explanation of key economic events and indicators. Foreign exchange is concentrating increasingly in the largest financial centres. The foreign exchange market is the biggest and most liquid market, reaching daily volumes of over $5 trillion.

However, many (not all) forextradingfirms are blackbox-systems with the purpose to give you, there customer, only losses and take your money as soon as possible. The foreign exchange (Forex) is the conversion of one currency into another currency. A forex broker is a service firm that offers clients the ability to trade currencies, whether for speculating or hedging or other purposes.

76% of retail investor accounts lose money when trading CFDs with this provider.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Lose too much of it while trading and you may be put off by the notion of risking money in financial markets altogether.

With spread betting you stake a certain amount (in your account currency) per pip movement in the price of the forex pair. So for instance you might buy (or sell) £10 per pip on USD/JPY, to make £10 for every pip the US dollar rises (or falls) against the Japanese yen. Forex traders have been using spread betting to capitalise on short-term movements for many years now.Find out more about spread betting. The daily chart gives us the best combination of accuracy and frequency of price action trading setups. Meaning, you will get a much clearer, accurate, and more relevant view of a market’s price action on the daily chart than you will on any time frame below it.

I have a good friend in Singapore who turned a 10k in to over a million account in 24 months (2 years). He is a very good trader probably one of the best I personally know and I’m not saying it is meant for everybody. I really found interest in it as for it is interesting to see what others think about the stock market . 2 weeks in the trading industry with only demo accounts on some trading software, I will completely deny upon your opinion. So, the answer of this question that whether it is possible to become a millionaire through Forex trading, is in the facts that I explained in details above.

By asking this question, I have a hunch you don’t fully understand Forex yet. Stick to demo trading for now, read my previous articles on how to develop a working strategy. Once you can show a minimum of 100 trades in a row without a loss, you are ready to place 10K and earn profits the same week already. With many brokers, a forex trader can start with less than $500 and plan to make ten cents per pip in a microlot trade.

Комментарии

Отправить комментарий